Auto Action Plan takes your borrowers from "Denied" to "Approved" allowing you to Sell More Cars!

If you interested in using Auto Action Plan to close more loans or you would like more information about how we can maximize your borrowers' credit scores, please reach out.

The current issues that are plaguing credit-reliant industries and how we can be a game- changer in addressing these challenges. What Challenges Are Auto Dealers Facing? 2023 has been a year of trials and tribulations for the auto industry as a whole. Rising interest rates and decreased applications are just a few of the issues holding them back from seeing as much success as they have in the past.

Auto Dealerships operate in an environment that's heavily influenced by economic fluctuations, regulatory changes, and customer expectations. Recently, the industry has also seen increased scrutiny and tighter regulations, making it more difficult for dealerships to navigate compliance hurdles. One of the more prevalent challenges we’re seeing is the need for efficient credit solutions.

Auto Dealerships are seeking ways to enhance client creditworthiness without violating regulations or compromising ethical standards. This is where ScoreNavigator's innovative Point Deduction Technology® comes into play. This one-of-a-kind technology focuses on identifying and mitigating negative credit factors while providing options for the future. It offers a nuanced approach that still aligns with industry standards and regulations.

In addition to this effective solution, we created the Auto Action Plan, a product of ScoreNavigator tailored for the auto industry, which offers a comprehensive strategy for auto dealerships. This plan goes beyond any traditional credit program or service, providing a structured pathway for addressing credit issues and increasing the chances of loan approval. This is just one of many auto solutions that we have to offer.

Consumers, on the other hand, face their own set of challenges when it comes to securing loans or financing. Economic uncertainties, job instability, and unforeseen life events impact credit scores, making it challenging to access favorable lending terms.

Especially with the state of the economy at present, it has become harder than ever to remain on top of personal finances. For those shopping for homes and vehicles, in particular, interest rates are making it difficult to make any large purchases, regardless of money in the bank. Credit scores are one of the largest factors considered when it comes to these investments, and without a solid score, the odds of approval are slim.

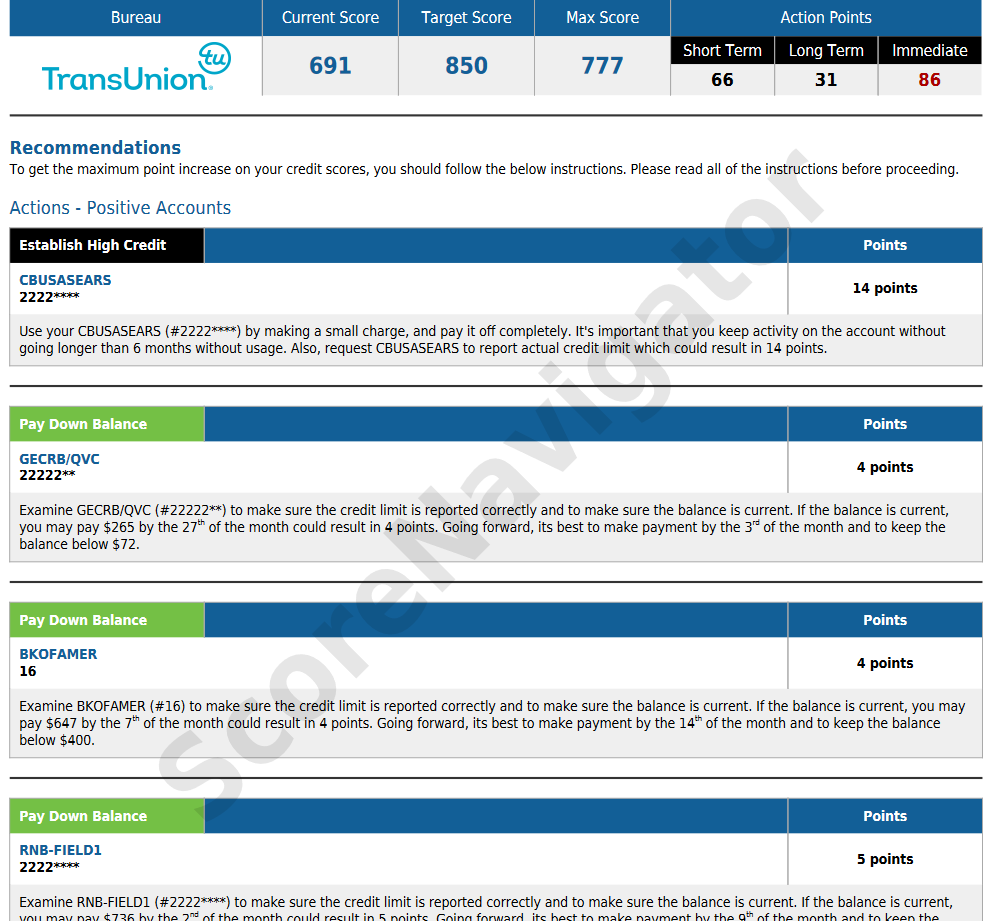

Consumers should always have a game plan when it comes to their finances, and this can be difficult, especially without prior education or specialization. Many people may find themselves in situations where they maintain decent enough credit scores but are inundated with a high debt-to-income ratio (or DTI). This is where the Auto Action Plan comes into play. AAP offers a strategic game plan by pinpointing which accounts require the most attention and putting together an action plan to pay them down. This targeted approach results in lowering the DTI, providing consumers with a tangible strategy to improve their financial standing. In return, they can see their approval odds skyrocket.

If you interested in using Auto Action Plan to close more loans or you would like more information about how we can maximize your borrowers' credit scores, please reach out.

At ScoreNavigator, we understand the sensitive nature of credit concerns and provide consumers with access to simulators that empower them to explore various financial scenarios. Through this tool, consumers are able to make informed decisions, understand the potential impact of financial choices, and work towards a more secure credit future. At ScoreNavigator, we're committed to providing innovative solutions, as evidenced by our Point Deduction Technology® and Auto Action Plan. As we continue to navigate the current economic conditions, we help our customers find peace in their ability to understand and demystify the state of their credit.

Interested in using Auto Action Plan™ to Close More Loans?

Click Here To Contact Us Today

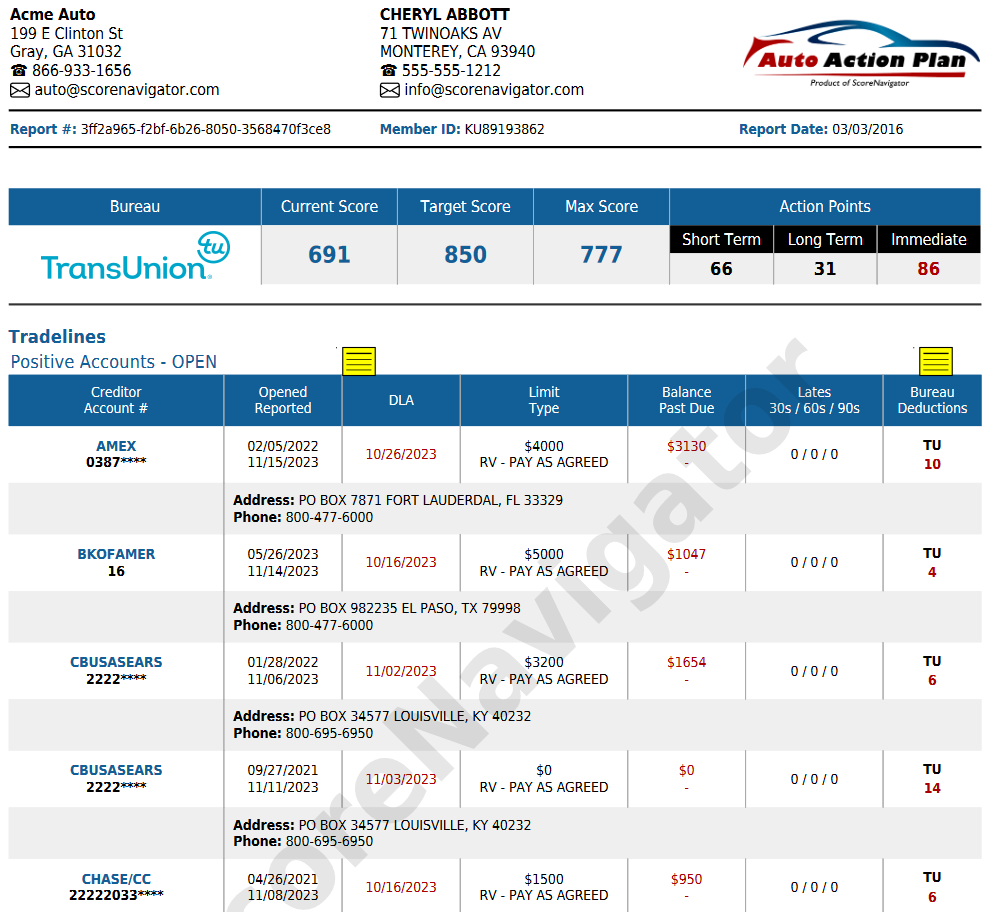

The Tradelines Report details all the specifics of each of the tradelines in a tri-merge format including ScoreNavigator's own Point Deduction Technology®. Accounts are separated grouped by type: positive, negative, collections and public records.

The Recommendations Report details recommended actions for both positive and negative accounts, including the estimated point deduction for each action. Actions include paying down balances, reporting actual credit limits, checking for inaccuracies, and more.

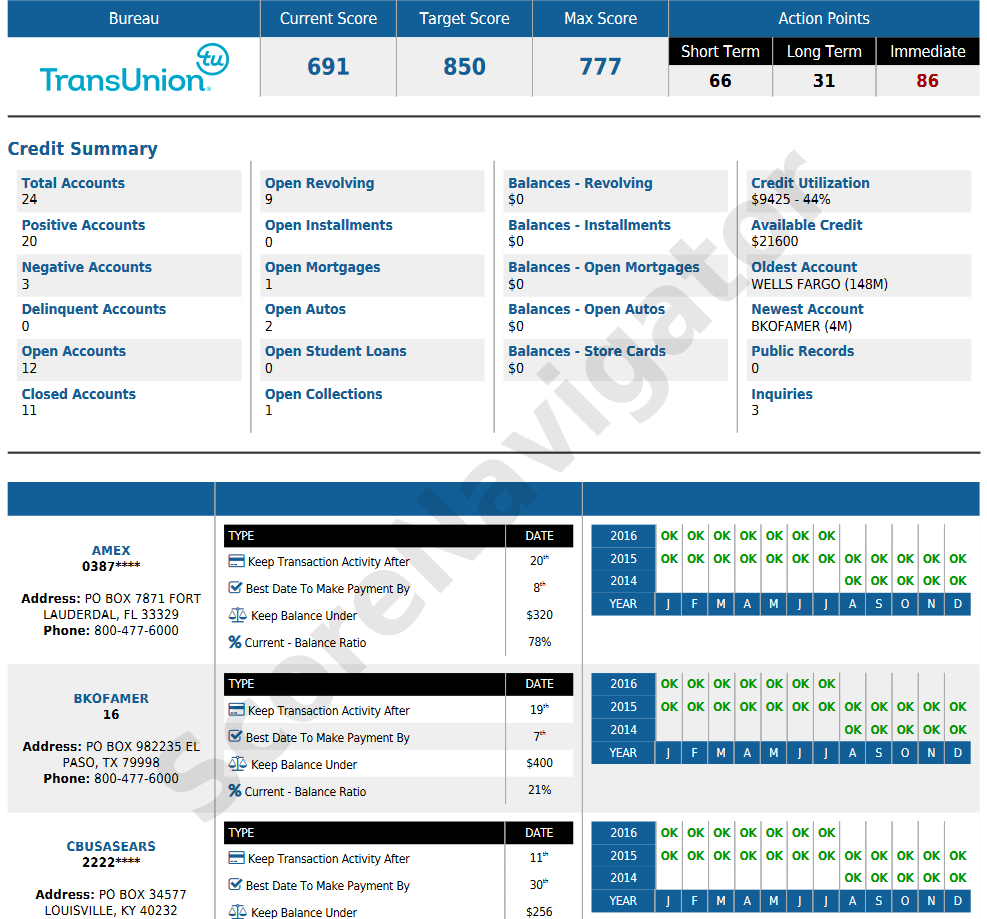

The Summary Report details a complete Credit Summary, a Payment History, and an account specific instructions, such as the best date to make payment, current and ideal balance ratios, and more.

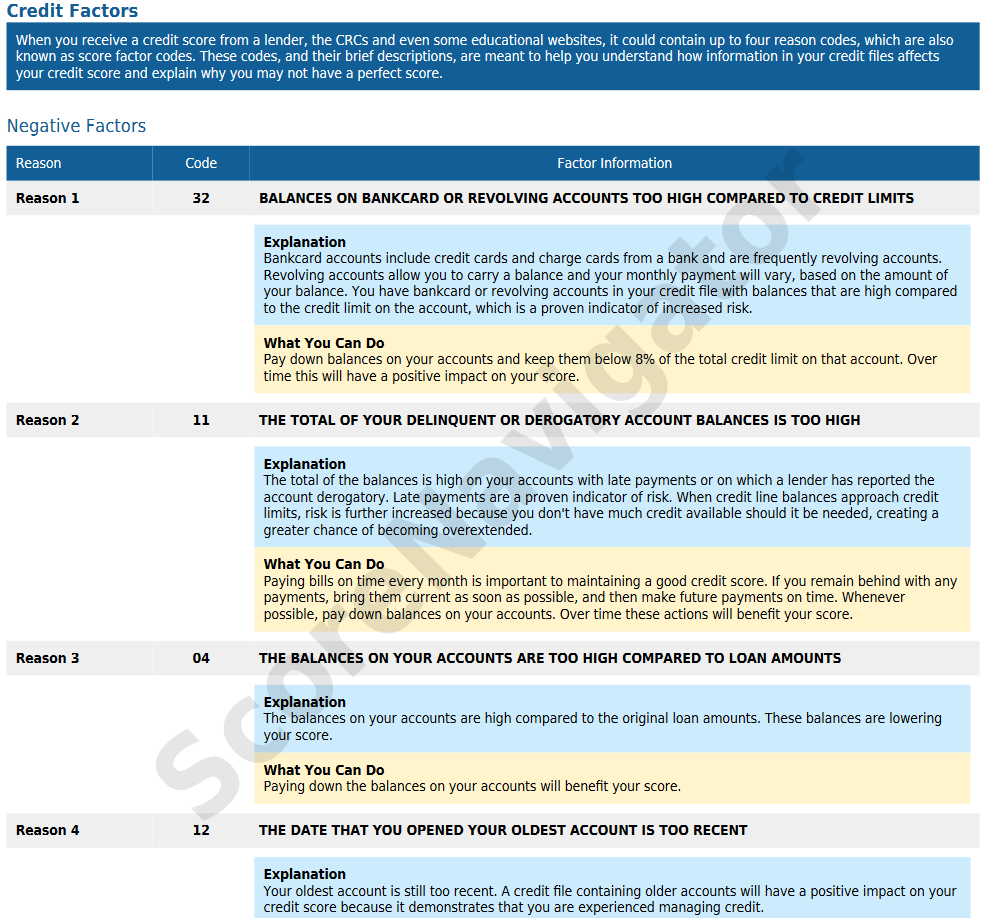

The Factors Report details up to four negative credit factors. The reason code and description are readily available, but ScoreNavigator provides enhanced factor codes, including factor explanations and actions need to be taken in plain terms. Positive Factors are given where available.

The Scenarios Report details two point improvement scenarios for each of our own Target Score Simulator® and our Money Simulator.

Credit Scoring is a number generated also by a mathematical Algorithm – An Algorithm is defined as a set of rules for solving a problem in a finite (gathering of possibilities) numbers of steps, as for finding the greatest common divisor. FICO and Vantage Score built the most commonly used Algorithm based on credit data provided to the major credit bureaus, Transunion, Equifax, and Experian. The data comes from creditors on tens of millions of people. Your credit is cross referenced to the tens of millions of people’s credit data and a number (credit score)is assigned. Both FICO and Vantage Scores range from 300 to 850. This number determines the probability on how likely you are to pay your bills on time.

Point Deduction Technology Software also analyzes each tradeline from all three credit bureaus, Transunion, Equifax, and Experian to determine the differences and similarities on your credit file. Unlike credit scoring models which only provides an accumulative score, point deduction technology software posts the accumulative deductions but also posts the deduction on each individual tradeline account.

Point Deduction Technology Software doesn’t just look for the potential point recovery but also highlights where most errors occur on a credit report, provides short and long term recommendations on how to recover some or all of the missing points but also determines the best balance, day to pay, day to charge, and the best day to have your credit looked at for financing.

Unlike other scoring algorithm products, Point Deduction Technology Software was created for individuals not just companies to get a better understanding on how the individuals score is derived. With credit scoring ranging from 300 to 850, there are 550 points to analyze.

Even if all credit data regarding consumers held at credit repositories were accurate, complete, and current, there would be significant concerns about the fairness of automated credit scoring programs. Converting the complex and often conflicting information contained in credit reports into a numerical shorthand is a complex process, and requires a significant number of interpretive decisions to be made at the design level. From determining the relative influence of various credit-related behaviors, to the process used to evaluate inconsistent information, there is a great potential for variance among scoring system designs.

A Federal Trade Commission study of the U.S. credit reporting industry found that five percent of consumers had errors on one of their three major credit reports that could lead to them paying more for products such as auto loans and insurance.

Overall, the congressionally mandated study on credit report accuracy found that one in five consumers had an error on at least one of their three credit reports.

"These are eye-opening numbers for American consumers," said Howard Shelanski, Director of the FTC’s Bureau of Economics. "The results of this first-of-its-kind study make it clear that consumers should check their credit reports regularly. If they don't, they are potentially putting their pocketbooks at risk."The study, in which participants were encouraged to use the Fair Credit Reporting Act (FCRA) process to resolve any potential credit report errors, also found that:

Point Deduction Technology Software determines the impact errors and omissions cause and provides remedies to recover some or all the lost points back.

Target Score Simulator is an innovative product allowing you to enter a target score and based on credit data will provide a plan to achieve the score.

The Score Simulator extracts your credit data and adds the assigned point deductions. This information, along with the ability to change the status of each account, allows you to build a plan through several scenarios enabling you to capture and/or build points.

It's important to be provided with necessary recommendations in order to maximize your score.